Finecapital Ltd. was founded in 2010 in Bern as an independent asset manager. The share capital is owned by the partners. Finecapital Ltd. is legally and financially independent. Our core competencies are asset advice and management as well as asset services and are exclusively aimed at professional clients according to Art. 4 FIDLEG. We work with carefully selected custodian banks and external service providers. Finecapital Ltd. is a member of the Swiss Association of Asset Managers (VSV). The VSV is the leading national industry association of independent asset managers in Switzerland. Membership of the VSV is regarded as a seal of quality for serious and high-quality advice and services in the area of support and management of your assets.

Finecapital Ltd. has the necessary authorisation from the Swiss Financial Market Supervisory Authority FINMA as an asset manager within the meaning of the Financial Institutions Act (FINIG) and is subject to supervision by the Swiss Corporation for Supervision AOOS. The AOOS is a supervisory organisation (AO) authorised and supervised by the Swiss Financial Market Supervisory Authority FINMA.

Our edge in comparison to other independent asset managers is that we have three complementary business lines as core competencies (Real Estate Switzerland, physical precious metals trading and storage and classical wealth management). All businesses are lead by partners who have a long track record and many years of experience in the respective field. This unique combination of different though complementing businesses with comprehensive expertise clearly distinguishes us from others.

Your needs and goals are of utmost importance to us. Therefore we will take our time to get to know these comprehensively. Hence we will together develop a customized and individual investment strategy for you. The result of this intense collaboration is based upon mutual trust.

As Wealth Manager and -Advisor we are completely independent from banks, lawyers and trustees. That’s how we avoid conflicts of interests at all times. We regard ourselves at ambassadors of your interests and will solely advocate for your needs. This includes that we inform you comprehensively and in a transparent manner about our fees and services.

Wealth Management is a very personal business. Out of that reason we take our time to develop with you your personal risk profile and customized asset allocation. Our partners have a combined 100 years of experience in all areas of Wealth Management and are also capable to deal with and implement complex client needs.

We pay the highest attention to personal service as well as committing ourselves extensively to your client needs. Every client has his own risk profile and asset allocation.

Our core competencies are:

For services beyond our core competencies we will call in carefully selected external specialists.

Especially when it comes to dealing with financial assets, humans act not at all rationally. This emotionality combined with the increasing flood of information in today’s digital age leads to suboptimal decisions and below average performance. A systematic investment process can address these challenges and can make use of the systematic mistakes of other market participants respectively. We believe in recurring patterns on financial markets and combine specifically fundamental and market psychological insights.

To be successful when it comes to investing two decisions are of utmost importance:

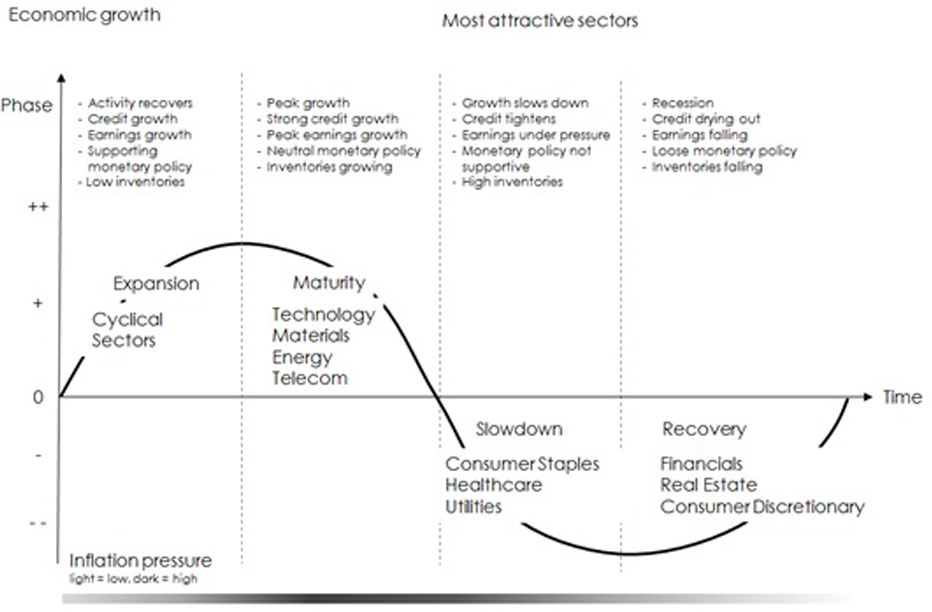

A dynamic asset allocation to specifically dampen weakness periods of equity markets is the key for successful investing. Our systematic process analyzes on a regular basis the fundamental- and market psychological environment on financial markets and adjusts the equity allocation accordingly.

Single equities often show strong divergence when it comes to return patterns. It helps a lot to analyze on a regular basis the relevant drivers of equity performance to distinguish the winners from the losers. Next to company specific factors like valuation and growth the sector affiliation is an important element. Equities within the same sector show in many cases strong parallel movements. By determining the attractiveness of the sectors over time there is a lot of value to be added.

Our investment approach allows us to easily implement our service offering on modular basis and in different structures. For the implementation of our investment process the following offerings and instruments are possible:

Source: Finecapital